- Have any questions?

- (02) 8579-9170

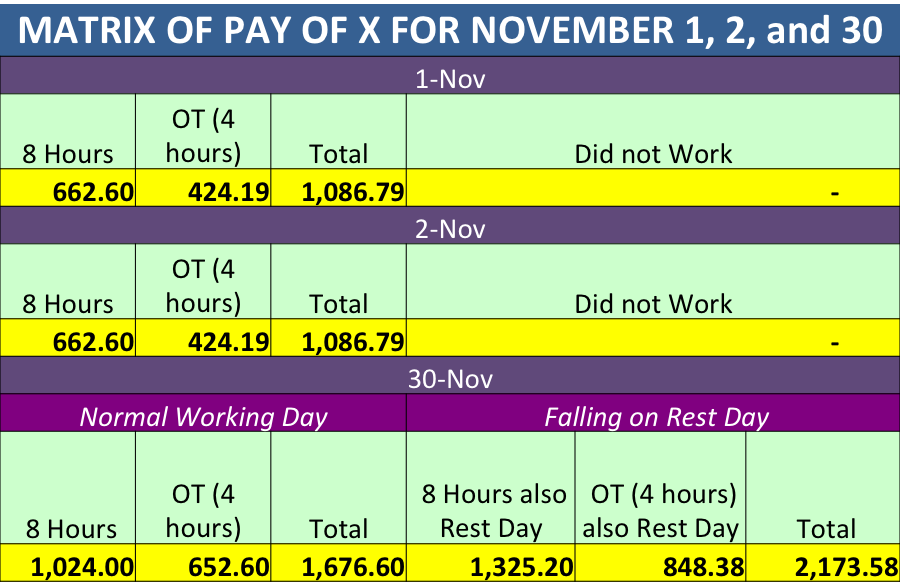

HOLIDAY PAY COMPUTATION FOR NOVEMBER 1, 2, and 30 WITH ILLUSTRATION

Special days under R.A. 9492 include the All Saints Day falling on November 1. Presidential Proclamation No. 269 declared November 2, 2018 as additional special non-working days throughout the country intended to strengthen family ties by providing more time for the traditional “All Saint’s Day and All Soul’s Day.

November 30, 2018 is Bonifacio Day which is a regular holiday under R.A. 9492.

Now, during these November special days and regular holidays, employees have to get paid under certain situation. In all, HR practitioners should be ready with the computation on the following days:

- November 1, 2018

- November 2, 2018

- November 30, 2018

Since November 1 and November 2 belong to the same category, special days, they should be computed under the same rules. The rules on the payment of special days are as follows:

- If the employee work on these days, he shall be paid an additional 30% of his daily rate on the first eight hours or [(Daily Rate x 130%) + COLA];

- If he worked in excess of eight hours (overtime), he shall be paid an additional 30% of his hourly rate or [(Hourly Rate of the basic daily wage x 130% x 130% x number of hours worked)].

- But if the employee did not work on said days, the ‘‘no work, no pay’’ principle shall apply, unless there is a favorable company policy, practice or collective bargaining agreement (CBA) granting payment on special holidays.

Illustration for pay on November 1, 2018:

Scenario A:

X, a rank-and-file employee in NCR was required to work on November 1, from 8:00 a.m. to 5:00 p.m. or for eight (8) hours. He is paid minimum. How much should he get paid on such day?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Formula:

[(Daily Rate x 130%) + COLA]

[(P502.00 x 130%) + P10.00]

[(P652.60)+P10.00]

Guide on Employee Compensation and Benefits Volume 2

Scenario A.1:

If X did not work on November 1, he has no pay since the rule that applies on special day is “no work, no pay.”

Scenario A.2:

X rendered an overtime work on November 1 from 5:00 p.m. to 9:00 p.m. or a total of 4 hours. How much should he get paid on such OT work?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Hourly rate of basic wage – P502.00 / 8 hours = P62.75

Formula:

[(Hourly Rate of the basic daily wage x 130% x 130% x number of hours worked)]

[(P62.75 x 130% x 130% x 4 hours)]

[(P81.575 x 130% x 4 hours)]

[(P106.05 x 4 hours)]

P424.19

Illustration for pay on November 2, 2018:

Scenario B:

X, a rank-and-file employee in NCR was required to work on November 2, from 8:00 a.m. to 5:00 p.m. or for eight (8) hours. He is paid minimum. How much should he get paid on such day?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Formula:

[(Daily Rate x 130%) + COLA]

[(P502.00 x 130%) + P10.00]

[(P652.60)+P10.00]

P662.60

Scenario B.1:

If X did not work on November 2, he has no pay since the rule that applies on special day is “no work, no pay.”

Scenario B.2:

X rendered an overtime work on November 2 from 5:00 p.m. to 9:00 p.m. or a total of 4 hours. How much should he get paid on such OT work?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Hourly rate of basic wage – P502.00 / 8 hours = P62.75

Formula:

[(Hourly Rate of the basic daily wage x 130% x 130% x number of hours worked)]

[(P62.75 x 130% x 130% x 4 hours)]

[(P81.575 x 130% x 4 hours)]

[(P106.05 x 4 hours)]

P424.19

Now, the rule on November 30, 2018 which is a regular holiday states that:

- If the employee worked on November 30, he shall be paid 200% of his regular pay for the first eight hours or [(Daily Rate +COLA) x 200%].

- If he worked in excess of eight hours (overtime), he shall be paid an additional 30% of his hourly rate or [(Hourly Rate of the basic daily wage x 200% x 130% x number of hours worked)].

- If he worked on this day which also falls on his rest day he shall be paid an additional 30% of his daily rate of 200% or [(Daily Rate + COLA) x 200%] + [30% (Daily rate x 200%)].

- If he worked on November 30 which also falls on his rest day and was required to render overtime work he shall be paid an additional 30% of his/her hourly rate, or [(Hourly Rate of the basic daily wage x 200% x 130% x 130% x number of hours worked)].

- If he did not report to work on November 30, he shall still be paid 100% of his salary for that day or [(Daily Rate + COLA) x 100%].

Illustration for pay on November 30, 2018:

Scenario C:

X, a rank-and-file employee in NCR was required to work on November 30, from 8:00 a.m. to 5:00 p.m. or for eight (8) hours. He is paid minimum. How much should he get paid on such day?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Formula:

[(Daily Rate +COLA) x 200%]

[(P502.00 + P10.00) x 200%]

[(P512.00) x 200%]

P1,024.00

Scenario C.1:

X, a rank-and-file employee in NCR was required to work on November 30 in excess of eight (8) hours or from 5:00 p.m. to 9:00 p.m. or a total of 4 hours of OT work. How much should he get paid for such OT work?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Hourly rate of basic wage – P502.00 / 8 hours = P62.75

Formula:

[(Hourly Rate of the basic daily wage x 200% x 130% x number of hours worked)]

[(P62.75 x 200% x 130% x 4 hours)]

[(P125.50 x 130% x 4 hours)]

[(P163.15 x 4 hours)]

P652.60

Scenario C.2:

X, a rank-and-file employee in NCR was required to work on November 30 which also falls on his rest day. How much should he get paid on such day?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Formula:

[(Daily Rate + COLA) x 200%] + [30% (Daily rate x 200%)]

[(P502.00 + P10.00) x 200%] + [30% (P502.00 x 200%)]

[(P512.00) x 200%] + [30% (P1,004.00)]

[P1,024.00] + [P301.20]

P1,325.20

Scenario C.3:

X, a rank-and-file employee in NCR was required to work on November 30 which also falls on his rest day beyond eight (8) hours or from 5:00 p.m. to 9:00 p.m. or a total OT work of 4 hours. How much should he get paid for his 4 hours of OT work on such day which falls on his rest day as well?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Hourly rate of basic wage – P502.00 / 8 hours = P62.75

Formula:

[(Hourly Rate of the basic daily wage x 200% x 130% x 130% x number of hours worked)]

[(P62.75 x 200% x 130% x 130% x 4 hours)]

[(P125.50 x 130% x 130% x 4 hours)]

[(P163.15 x 130% x 4 hours)]

[(P212.10 x 4 hours)]

P848.38

Scenario C.4:

X, did not work on November 30. How much should he get paid on such day?

NCR Minimum wage – P512.00 consisting of P502.00 basic wage and P10.00 COLA

Formula:

[(Daily Rate + COLA) x 100%]

[(P502.00 + 10.00) x 100%]

[(P512.00) x 100%]

P512.00

Here’s the matrix of his pay on November 1, 2, and 30: